Meet Mike and Pam:

After years of hard work and dedication, Mike and Pam are ready to embrace their next adventure - retirement. Mike (60) and Pam (57) are a happily married couple in Cincinnati. Mike was an executive at a large, local company, where he worked for 30 years. Pam worked as an outpatient nurse with the same practice for 15 years. With their children grown and raising families of their own, the couple is excited to shift their focus toward each other, their passions, and the freedom they’ve worked so hard to achieve.

They’ve spent decades being mindful with their finances, ensuring that they never went without but also planning for a future where they wouldn’t have to worry. Now, standing on the threshold of retirement, they feel a mix of excitement and cautious optimism. They know they’ve saved well, but the transition from earning a paycheck to living off their investments is a little daunting. Still, they’re ready to take the leap!

Mike and Pam’s plans for retirement:

One of the biggest motivators for retiring now is their grandkids. Their three young grandchildren bring them immense joy, and they want to be present in their lives; whether it’s a school play, a soccer game, or just an afternoon playing in the backyard. Pam dreams of hosting the grandkids for sleepovers and teaching them family recipes, while Mike looks forward to weekend fishing trips and summer camping adventures.

Beyond family, travel has always been a shared passion. Over the years, their busy schedules only allowed for quick getaways, but now they have the time to explore more and go abroad. Their first big trip? A month-long journey through Europe, starting in Italy, where they’ll indulge in pasta-making classes, sip wine in Tuscany, and finally see the Amalfi Coast. After that, they’re considering renting an RV to tour America’s national parks, something they’ve talked about for years but never had the time to do.

Neither Mike nor Pam see themselves as the type to sit around all day. Mike has already joined his local country club and is excited to get in more rounds of golf and lower his handicap. Pam, with her deep sense of compassion, has been exploring volunteer opportunities at the local children’s hospital.

Finances:

Miike & Pam both took advantage of the retirement plans available to them through their employers and have let money accumulate inside their savings account as well. They feel they’re sitting on too much cash but are nervous to invest it at the wrong time, especially now that their paychecks are gone. They also have a small taxable investment account that they opened & funded many years ago at the recommendation of a friend, but they were not consistent with their contributions.

Assets & income

- Mike’s 401(k): $1,350,000

- Pam’s 401(k): $375,000

- Jointly-owned taxable account: $120,000

- Jointly-owned savings: $150,000

- Mike’s Social Security benefits at age 67: $3,987/mo

- Pam’s Social Security benefits at age 67: $2,536/mo

- House: $500k value and no mortgage

Expenses & goals

- Living expenses: $7,000/mo or $84,000/yr (including property taxes and health insurance premiums)

- Annual vacations: $18,000

Financial review

Mike & Pam have about $1,845,000 in investments, not including their savings account or home equity. They plan to spend at least $8,500/mo or $102,000/yr

Mike and Pam’s retirement income plan:

Mike & Pam are looking to spend at least $8,500/mo or $102,000/yr.

Can they? Can they do that year after year after year? Or will they be at risk of running out of money?

Fortunately, Mike & Pam’s plan can support spending of over $10,800/mo!

After taxes, that is just over $9,700/mo., which is well above their desired spending level.

It’s nice being able to spend more than you anticipate because they may want to host a large family vacation with all their kids and grandkids. Or they may buy a convertible for the summer months! There are unknowns that their finances can support, which is an amazing feeling and a key ingredient to a secure retirement.

What if the market goes down?

Mike and Pam both get anxious when thinking about the stock market going down. They’ve been investing long enough to know that it happens, but it still makes them uneasy. Mike knows his country club membership is a luxury and that if it came to it, he could walk away to cut back on spending. Pam is nervous that they won’t be able to travel like they imagined if the stock market falls.

What Mike and Pam have right now is fear without context. They are imagining a stock market correction that leads to them needing to stop all discretionary spending and live out the rest of their days like hermits. What Mike and Pam are missing is the context of how much their spending would need to be reduced if markets fell…

What would happen to their spending capacity if markets fell 10%?

What would happen if markets fell 20%? 30%?!

What Mike and Pam need is a plan for when to decrease their spending and a plan for when to increase their spending!

What Mike and Pam need are guardrails…

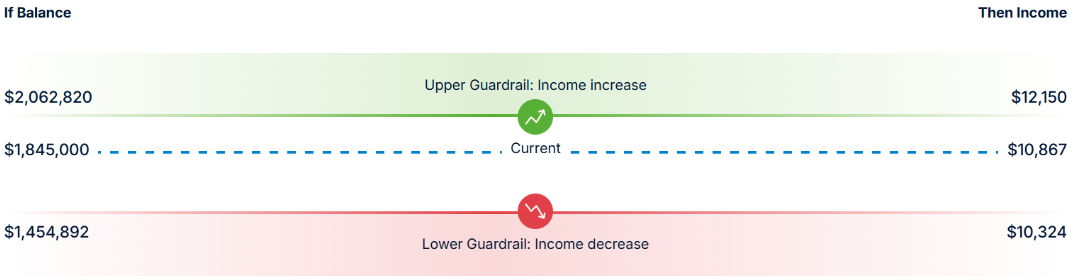

Mike and Pam’s current balance of $1,845,000 gives them the spending capacity of $10,867.

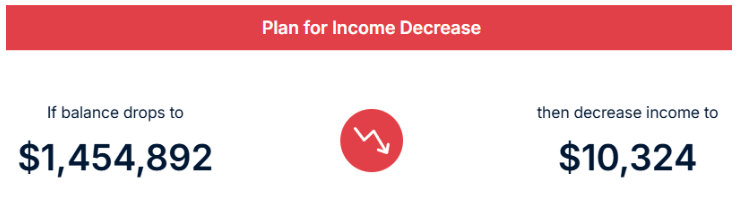

If the stock market fell and their investment account balances dropped to $1,454,892, then a spending adjustment would be recommended!

Is that spending adjustment forcing them to cancel all vacations and club memberships? No. The spending capacity decreases from $10,867/mo to $10,324/mo.

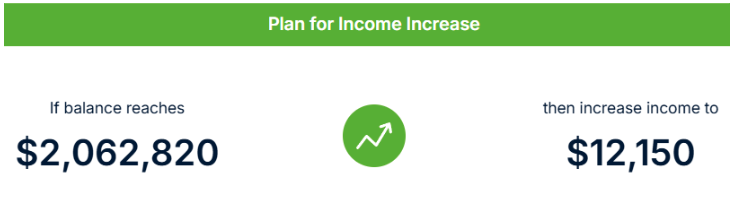

We can’t only talk about bad news and bad markets. We get to talk about good markets, bull markets, as well!

We see that if Mike and Pam’s investment perform well and their balances grow to $2,062,820, then they could start spending more! Up to $12,150/mo!

How do Mike and Pam feel now?

After some initial worries about the transition into retirement, Mike and Pam are now thriving - and they couldn’t be happier! What started as uncertainty about investing and managing their withdrawals has turned into a deep sense of confidence.

Their advisor helped them create a clear retirement income strategy, ensuring they had enough cash reserves for peace of mind while keeping their investments positioned for long-term growth. They now understand their money better than ever - knowing exactly how much they can spend without worrying about running out. They no longer stress about market fluctuations because they have a well-thought-out plan that allows them to ride through the ups and downs without panic.

Most importantly, they’ve discovered a newfound sense of freedom and excitement for this stage of life. With a solid financial plan and a trusted financial advisor by their side, they no longer worry about money; they simply enjoy life.

Do you want to feel like Mike and Pam?

Retirement should be about confidence, not uncertainty. My wealth management clients receive:

✅ A retirement income strategy to ensure your money lasts✅ Retirement guardrails to know when to adjust spending to protect against market downturns

✅ Peace of mind knowing you have a clear, flexible plan for the future

If you're ready to retire with clarity and confidence, let’s talk! Schedule a consultation with AJD Wealth Management today.